Spotlight: Film Industry Statistics and Trends 2024

Spotlight On Film Industry Statistics For 2024

The film industry has experienced ups, downs, and disruptions over the last few years. From the after-effects of the pandemic to strikes and the challenges posed by streaming services, the industry landscape is not the same place it was in 2019.

However, the film industry statistics that we’ve put together show that, despite the upheavals, independent filmmakers, studios, cinema, and TV programs are here to stay.

What the Public Thinks about the Film Industry

In the film industry, the audience is the biggest critic, and even if a release gets rave reviews, it can flop if the public doesn’t enjoy what it sees.

Using data from Polly sourced from an independent sample of 2,950,625 people* from Twitter, Reddit and TikTok worldwide from March 13, 2023, to March 13, 2024, we delved deeper into what people really think about the state of the film industry.

Hollywood Remains a Frontrunner

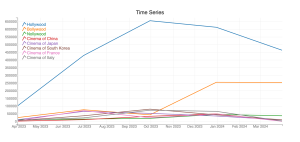

Hollywood has been the home of movies since the 1920s, and this remains unchanged. The graph below clearly shows which country’s film industries are getting people talking online.

Based on Polly’s results, it’s easy to see how Hollywood is thriving. From April 2023 to October of the same year, engagement levels far exceeded those of any other country. However, after peaking in October, it slid somewhat in online mentions, dipping to June 2023 levels in March 2024. With the end of the writer’s strike, Hollywood now has potentially even bigger problems, and the next twelve months may see it lose out on even more online conversations.

Bollywood’s engagement levels may be far lower than Hollywood’s, but unlike the US home of film, the Indian film industry hasn’t experienced as much of a decline in 2024.

Looking at the country that has the most consistent online engagement, it’s safe to say that Nollywood (Nigeria) is maintaining consistency. It may have nowhere near the engagement levels of Bollywood and Hollywood, but it certainly beats them in consistency.

Asian cinema hasn’t fared too well in the last twelve months, with China, Japan, and South Korea all experiencing declines in engagement in 2024. But France and Italy are really lagging, as interest in both has tapered off dramatically in 2024 after they experienced a few notable peaks in July and October 2023, respectively.

Bollywood Goes Mainstream

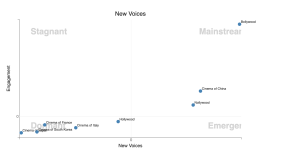

While Hollywood may be the most thriving film industry according to online mentions, it’s not really getting new people talking. In the below graph, we can see that other countries are emerging as thriving film industries. Let’s unpack this:

Conversations about Bollywood, China, and Nollywood’s thriving film industries have become mainstream when comparing engagement in the last six months vs. the previous six months. This means that a growing number of people online are discussing the film industry in these countries, adding their numbers to the new voices.

In contrast, Hollywood, France, Italy, Japan, and South Korea remain dormant, with few new people discussing them online. For Hollywood, this lack of movement isn’t too concerning, but for the other countries, it’s indicative of how far they need to go to enter more mainstream conversations.

USA Tops Audience Engagement

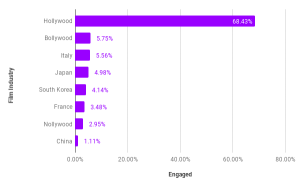

When it comes to online engagement, this graph shows exactly how much engagement each country’s film industry is getting.

Predictably, Hollywood remains on top of the countries with the most thriving film industries, but the enormous chasm between those engaging with the US film industry and those engaging with Bollywood highlights just how much of a conversation starter this industry is.

Interestingly, despite Italy and Japan showing low engagement figures over time and falling into the stagnant category, they both pick up traction here. Italy has only 1% less engagement than Bollywood, showing that Hollywood on the Tiber gets people talking, too.

Japan (5%) and South Korea (4.1%) beat France (3.5%) and Nigeria (2.95%) quite solidly, which is quite surprising as Nollywood has a good following and again fared well in the Time and New Voices categories. Last is China, which only records 1.1% of engagement, proving that people don’t think this country has a thriving film industry. At least, not yet.

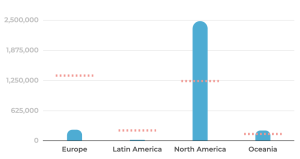

North America Loves Talking about Films

Polly’s data was extracted from four countries, and the following graph shows the number of people in each country engaging in online conversations about the film industry.

Based on what Polly revealed, it’s clear that expected engagement levels and actual engagement levels differed quite dramatically in certain areas. In each graph, the blue lines represent actual engagement and the red lines are the expected engagement.

Starting with North America, it’s evident that expected engagement versus actual engagement is almost double. While the expected level of engagement was just under 1,250,000, it’s actually nearly 2,500,00. This means that a vast number of people in North America are engaging in online conversations about the film industry.

In contrast, expected engagement in Europe was over 1,250,000, but actual engagement was woefully low. Latin America also had a higher expected engagement level but hardly registered actual engagement as the numbers were so low. Oceania was the only region with similar expected and actual engagement levels, with actual engagement levels only slightly higher than expected.

With Hollywood being such a powerhouse, it’s not surprising that North America registered such high actual engagement, but it is surprising to see how little engagement Europe registered, especially since it’s home to the French and Italian film industries.

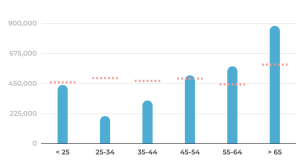

Over 65s Have the Biggest Interest in the Film Industry

Looking at the ages of those engaging in conversations about the film industry online, it’s evident that expected engagement (red line) versus actual engagement (blue line) differs once again. Let’s unpack how, in each age group, the expected versus actual engagement is far apart.

Starting with the oldest first, Polly revealed that those over 65 are the most engaged. They also far exceed expected engagement levels of around 500,000 by nearly hitting the actual engagement mark of 900,000. This may be because the older generation is mostly retired and has more time to watch TV and films and engage in online conversations.

The 55-64 age bracket also showed higher engagement levels than expected, while the 45-54 age group was almost neck and neck, with actual and expected levels being almost the same. Interestingly, the younger age groups of 35-44 and 25-34 both had higher expected engagement levels, whereas actual engagement was much lower – especially for the 25-34 category. The under-25 category just missed its target, coming in just under for actual versus expected engagement.

If you look at this graph, you’d think that those between the ages of 25 and 44 don’t spend much time discussing the film industry online, and you’d be right. This is an interesting reflection, especially when you consider that this age group has the highest number of social media users.

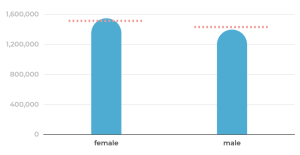

Women are More Engaged in Film Industry Conversations Online (but only just)

When it comes to gender, Polly’s data highlighted how expected and actual engagement was almost on the level for both men and women. Here’s how the battles of the sexes played out.

Female engagement just beats male engagement, and it’s almost exactly as expected. The number of women talking about the film industry online is just over what was predicted. For men, it’s the other way around. Male engagement is lower than female and just a bit lower than expected engagement levels.

The fact that these are so closely matched shows that interest in the industry is very evenly spread across both genders, and there are no real surprises when it comes to engagement levels.

A Glance at Cinema in 2023

Now we know who is talking about the film industry online and which countries are thriving based on public opinion, let’s take a quick look at stats from the Indy Film Library focusing on the general state of cinema around the globe in 2023:

- The total global box office gross in 2023 was $527,876,195.

- More than 50 million movie tickets were sold.

- Independent features accounted for one-fifth of the market.

- Global box office revenues grew by more than 29% in 2023, up from 21% in 2022.

In 2023, Barbie was the world’s highest-grossing movie, with ticket sales reaching $1.4 billion worldwide. Surprisingly, the Super Mario Bros. movie came in second, raking in $1.3 billion at the box office, followed by Oppenheimer, which made more than $952 million worldwide, and Guardians of the Galaxy Volume 3 in fourth place, grossing $845 million. The Hollywood writers’ and actors’ strike caused havoc for other much-hyped films and delayed the production and release of Deadpool 3, Blade, Craven the Hunter, and Dune: Part Two.

The top 10 independent features took a combined $1.6 billion at the global box office – almost 30% more than 2022’s takings. In 2023, independent horror movies punched above their weight, with Insidious: The Red Door taking $189 million worldwide, while Scream VI raked in $168 million. Indy films Meg 2: The Trench and PAW Patrol: The Mighty Movie took $395 million and $200 million globally too, while in total, $7.3 billion (21.7%) of 2023’s $33.4 billion global box office takings came from independent productions.

Independent Film in the United Kingdom

While 2023 was a good year for cinema in the United Kingdom and Ireland overall, independent films did not fare as well as they did in 2022. British Film Institute (BFI) statistics showed that UK-qualifying independent films saw a drop in revenue as well as in box office market share.

According to the BFI, an independent film is produced without financial or creative input from any of the major US studios. Those studios include Fox Entertainment Group, NBC Universal, Paramount Motion Pictures Group, Sony Pictures Entertainment, Walt Disney Motion Pictures Group, and Warner Bros Entertainment. That said, the BFI acknowledges some flexibility when it comes to productions by studio subsidiaries, especially where the film budget, filmmaker, and independent production companies are concerned.

- Some of the most important UK-Ireland independent and wider film industry statistics from 2023 include:

- Total UK-Ireland box office revenue climbed by 4% to £985.8 million in 2023 compared to 2022.

- 2023’s total UK-Ireland box office revenue was 24% lower than in 2019.

- Revenue for UK-qualifying independent films plunged by 49% in 2023.

- UK-qualifying independent films’ combined box office takings were £37.8 million, compared to 2022’s £74.7 million.

- UK-qualifying independent films’ box office market share was 3.8% in 2023, less than 50% of the share in 2022.

- Taking £5.3 million, The Great Escaper was the UK’s highest grossing independent film in 2023.

- The Great Escaper was the only UK independent film to take more than £5 million in 2023.

- Four UK independent films grossed more than £5 million in 2022: Belfast (£15.6 million), The Banshees Of Inisherin (£9.3 million),

- Operation Mincemeat (£5.3 million), and The Duke (£5.3 million).

Barbie set records in the UK, too, taking £95.6 million. It was the highest-grossing film in 2023 and the fifth-highest-grossing film of all time at the UK-Ireland box office. Barbie’s box office takings accounted for a whopping 9.7% of the year’s total takings in the UK, and the film contributed to non-independent UK qualifying films’ 37.1% market share.

- The total market share of UK films in 2023 was 40.8% – this was 11% higher than the UK market share in 2022.

- Other high-grossing UK-qualifying films in 2023 include Wonka, Mission: Impossible – Dead Reckoning, and Indiana Jones and the Dial of Destiny.

Highest Grossing Independent Films to Date

While none of the highest-grossing independent films to date were released in the last few years, according to Statista, these are the three biggest money-makers:

- As of March 2023, Mel Gibson’s The Passion of the Christ (2004) was the highest-grossing independent movie of all time – it grossed $917.94 million at the global box office.

- The Graduate (1967) is the second highest-grossing independent movie of all time – it grossed $784.36 million at the global box office.

- The most profitable movie in 2022 was independent horror M3GAN, which made an almost $80 million total profit.

Statistics For England, Scotland, Wales, and Northern Ireland

Let’s turn our attention to England, Scotland, Wales, and Northern Ireland for a moment and consider a few eye-opening statistics from 2023.

Mainstream film is faring better than independent film in these regions. While there have been welcome increases in admissions, the total value of ticket sales, and other areas, it’s clear that the industry is taking longer to bounce back to pre-pandemic levels than some commentators expected. While the following statistics from the BFI are by no means bad news, they illustrate that there is room for improvement:

- Total cinema admissions in the UK (excluding Ireland) for all 2023 film releases was 123.6 million – a 5.5% increase on 2022’s total admissions and 30% lower than in 2019.

- The total value of ticket sales in the UK (excluding Ireland) for the period 1 January to 31 December 2023 was £980 million – 8% higher than 2022’s £904 million and 22% lower than in 2019.

- 2023’s average ticket price of £7.92 was 3% higher than 2022’s £7.70 and 11% higher than in 2019.

- England’s total box office revenue in 2023 was 8% higher than in 2022 and 23% lower than in 2019.

- Wonka accounted for 33% of December 2023’s total box office in the UK (excluding Ireland).

- The 822 films released in the UK-Ireland in 2023 (excluding 22 Netflix productions that had theatrical releases and event cinema) grossed £985.8 million. This was 4% higher than the £945 million earned from 834 releases in 2022 and 24% lower than the £1.3 billion earned from 764 releases in 2019.

- Event cinema had a strong 2023 in the UK-Ireland: Taylor Swift: The Eras Tour earned £12.3 million, while Renaissance: A Film By

- Beyonce earned £1.7 million.

- Disney and Universal each released five of 2023’s top films, while Warner Bros released four of them.

Mainstream Cinema Statistics and Projections

As you can see from the statistics above, 2023 might not have been the best year in terms of independent or mainstream cinema, but it certainly was better than 2022. However, this upward trend might flounder somewhat in 2024, especially in light of the extended SAG-AFTRA and WGA strikes.

According to London-based box office analytics firm Gower Street, the Hollywood writers’ and actors’ strikes are the first post-pandemic setbacks that the industry has encountered, and it does not bode well for the industry this year. That said, the firm’s CEO, Dimitrios Mitsinikos, predicted that 2025 would be a much better year at the global box office, possibly to the point of setting a positive trend for the second half of this decade.

Important statistics and projections for the film industry from Gower Street include:

- Worldwide movie ticket sales in 2024 are projected to reach $31.5 billion – this is 5% lower than the $33.4 billion the firm forecast for 2023 but higher than 2022’s $25.9 billion and 2021’s $21.3 billion, but lower than 2019’s $42.3 billion.

- Gower Street attributed the predicted dip to a strike-related 50% loss of production time and consumer disinterest.

- 2024’s global cinema revenue is predicted to be 25% lower than in 2019.

- 2023’s cinema revenue in North America was projected to be between 20 and 22% higher than in 2022.

- 2024’s North American box office revenue is predicted to be $8 billion – this is 11% lower than in 2023 and 30% lower than the average for 2017-2019.

- 2024’s foreign box office (excluding China) revenues are predicted to reach $15.6 billion – this is 7% lower than in 2023 and 21% lower than the average for 2017-2019.

- Chinese box office revenues in 2024 are expected to reach $7.9 billion – this is 5% higher than the $7.6 billion projected for 2023.

General Film Industry Statistics For 2024

Continuing with the theme of looking back over the last few years, statistics for 2023, and predictions for the general film industry for 2024 and beyond, let’s explore a few thought-provoking statistics compiled by EnterpriseAppsToday:

- At $42.4 billion, the film industry is less valued in the entertainment category than the gaming industry ($145.7 billion).

- 3% of independent films do not receive a theatrical release.

- The US domestic box office generated $8.91 billion in 2023.

- The US cinema industry is expected to grow at an 8.3% CAGR by 2027.

- In 2023, the value of movie and video production in the US was $26.7 billion.

- The US film industry’s projected market size growth was 3.3% in 2023.

- The European film industry’s market share around the world was 26.5% in 2021.

- The global film industry’s annual revenue was $77 billion in 2021.

- China and the US are projected to be the top countries by the market in terms of projected highest revenue by 2025.

- Worldwide cinema box office revenues were $26 billion in 2022.

- North America was the highest-grossing territory in the box office domestic market in 2022.

- The average ticket price at US cinemas was $9.17 in 2022.

- As of 2023, the global movie production and distribution market size was $77.2 billion.

Film Statistics by Genre

Whereas most reports and research on mainstream and independent film industry statistics tend to focus on box office revenues, number of tickets sold, and market share, EnterpriseAppsToday went a step further to compile statistics by film genre.

A few highlight statistics around film genres include:

The action genre was the most popular, with 54 movies, revenues of $3,983,514,713, a 53.43% market share, and an estimated 434,407,251 tickets sold.

28 adventure movies were released, which generated gross revenues of $980,219,074, claimed a 13.15% market share, and saw 106,894,109 tickets sold.

59 comedy movies generated gross revenues of $691,113,850, claimed a 9.27% market share, and saw 75,366,805 tickets sold.

37 horror movies generated gross revenues of $634,214,244, claimed an 8.51% market share, and sold 69,161,842 tickets.

144 drama movies generated gross revenues of $621,137,428, enjoying an 8.33% market share, and selling 67,735,748 tickets.

46 thriller/suspense movies were released, which generated gross revenues of $249,909,212, a 3.35% market share, and 27,252,891 ticket sales.

11 romantic comedy movies generated gross revenues of $61,505,843, claimed a 1.41% market share, and sold 11,492,308 tickets.

6 musical movies generated gross revenues of $57,743,451, claimed a 0.83% market share, and sold 6,707,287 tickets.

1 reality movie was released. This single film generated revenues of $57,743,451, had a 0.77% market share, and sold 6,296,995 tickets.

3 black comedy movies generated revenues of $44,614,220, claimed a 0.60% market share, and sold 4,865,235 tickets.

Onward and Upward For The Film Industry In 2024

There’s no denying that the film industry has seen better days, but they have also been worse off than they are in 2023.

While 2024 will pose challenges of its own, it’s clear that the industry is slowly recovering from severe challenges while adapting to various disruptions. As these statistics make clear, it’s a case of onward and upwards, even if it’s taking longer than expected.

*About Polly’s Data

The responses were collected and analysed to produce outcomes within a 90% confidence interval and 5% margin of error. Engagement estimated how many people in the location are participating. Demographics were determined using many features, including name, location and self-disclosed description.

Privacy was preserved using k-anonymity and differential privacy. Results are based on what people describe online — questions were not posed to the people in the sample.